Destination Health Certifications Inspire Confidence among Travel Advisors and their Clients

Travel Consul, the leading international travel marketing alliance, has released the results of its second survey that reveals the impact of COVID-19 on the industry and the future recovery of global travel distribution.

Between 14th – 28th September 2020, over 1,000 travel executives (tour operators and agency owners) from over twenty outbound countries participated in the Travel Consul global survey. This second round gathered new insights related to health certifications, travellers’ preferences and international advance bookings.

Below are the key findings of the global survey:

Destination health certifications remain key for recovery

Once again, results from round II indicate that introducing health and safety certifications (nearly 60%) is the most important action destination organizations (DMOs) can do to help travel distribution partners. The next top three answers included marketing campaigns for consumers, presenting useful/timely data and info hub for trade partners.

When asked what the main client considerations are when choosing a destination, the number one answer is destination health and safety certification (74%). Destination country government management of the COVID-19 pandemic and price rank second and third, respectively.

Training leads to new product development

Business model adaptation is the no. 1 measure implemented during Q3 2020 as reported by nearly half of the respondents. Training programmes drop 11% with new product design (45%) and product improvement (35%) moving up the ranks.

Solo travel and hotels & resorts among the top travellers’ preferences

Clients are showing a growing interest in solo travel (66%), hotels and resorts (64%) and all-inclusive resorts (60%). These preferences are followed by self-catering rental accommodation, small groups 8-15 pax and fly-drives.

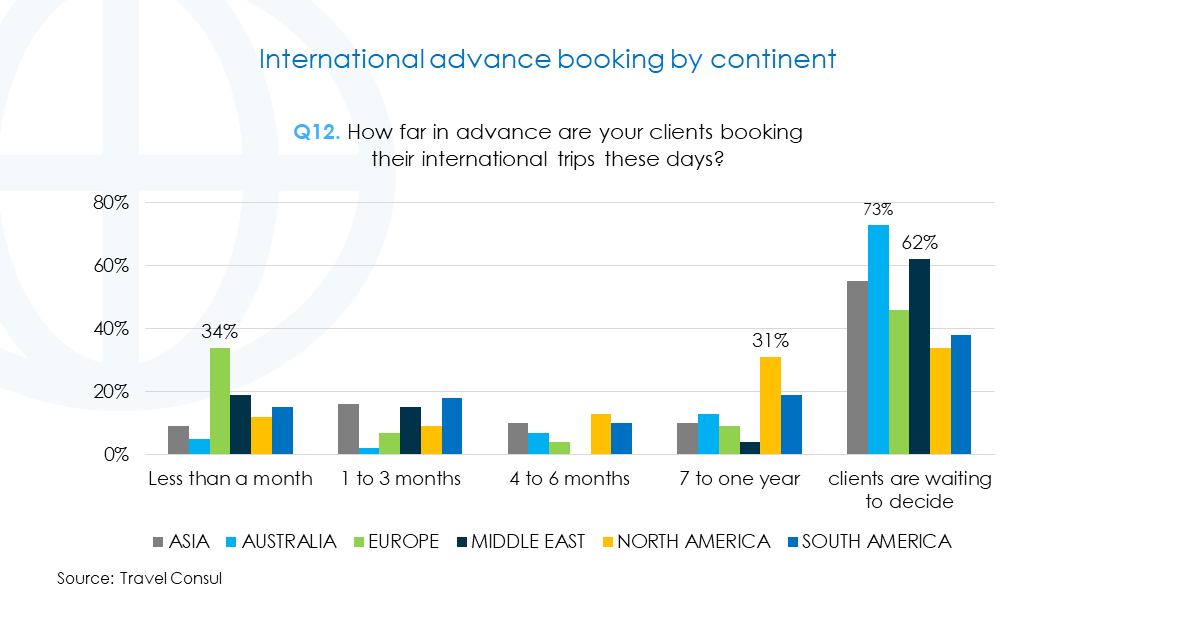

International advance bookings

Clients are either waiting to decide when to travel (48%) or are booking an international trip less than a month in advance (21%). Last minute bookings are becoming more prominent for European travellers (34%). In contrast, 31% of North American clients are booking a holiday seven months to one year before departure.

How supplier policies are affecting travel distribution partners

45% of distribution partners believe that suppliers’ cancellation and flexibility policies are having a positive impact on their businesses.

Travel associations reported as primary data sources

Tour operators and travel agencies associations remain the preferred data source during this crisis (64%) followed by destination tourist offices (40%). Industry friends (35%) moved from the fifth to the third position in round II.

Marketing efforts for recovery are focused on social media

Regarding marketing activities during recovery, social media was clearly the winner with seven out of ten respondents claiming that social marketing was their main concept. Digital and sales respectively came in second and third.

How COVID- 19 is redefining roles and tasks

Similar to the first round of this survey, 70% of the respondents believe that modifying cancellation policies or terms and conditions will be among their main undertakings in 2020 and 2021. Offering insurance policies, however, saw a 12% increase.

DOWNLOAD THE FULL REPORT

Global Travel Distribution. COVID-19 Impact. October 2020 FULL REPORT

—

The views and opinions expressed in this blog are those of the authors and do not necessarily reflect the official policy or position of any other agency member of Travel Consul.